DoubleVerify (DV) reaped the benefits of a cautious Q4 for ad spending – and it will continue to benefit as measuring performance remains a priority for advertisers.

The measurement company reported a 27% growth rate (at $133.6 million, up from $105.5 million last year) in Q4. That growth came during a rough quarter for publishers and ad tech companies, which largely saw revenue drop or remain flat.

“Media quality, which is what we measure and verify, is the basis for all performance,” DoubleVerify CEO Mark Zagorski told investors on Wednesday. “In good times, it resonates. And in times in which ad budgets may be a little tight, it resonates even more.”

Well, clearly, it’s resonating: DV’s stock jumped roughly 14% in after-hours trading.

By the numbers

For total 2022 revenue, DV saw a 36% growth rate to the tune of $452 million. The company measured 5.5 trillion ad transactions over the course of the year.

Activation revenue, which is how DV describes revenue from its brand safety and suitability products, accounted for $75.5 million in Q4, up 40% YOY.

DV is continuing to add products to its safety and suitability suite. Earlier this week, it launched a solution called Authentic Direct that helps publishers lower their block rates for direct-sold inventory.

Revenue from DV’s measurement suite in Q4 was $46.3 million, up 10% YOY.

The company attributed much of its Q4 growth to new clients adopting its platform, including General Mills, Dropbox, Adobe Japan and Amazon Prime Video. Its Q4 client win rate was 80%, with 67% of these being new clients.

The trifecta: CTV, retail media and social

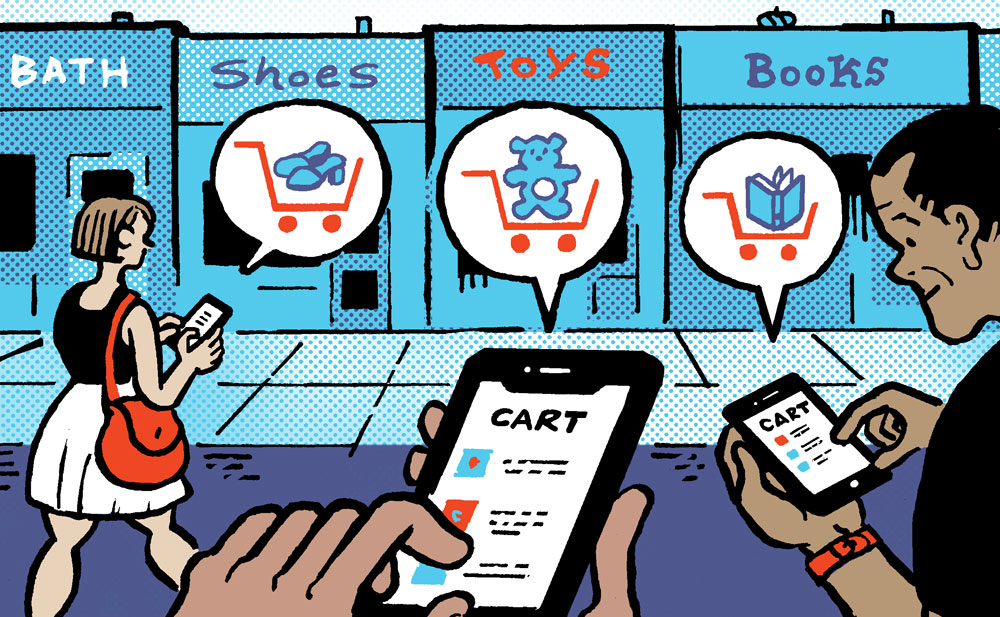

DoubleVerify sees connected TV, retail media and social media as its best long-term growth opportunities.

The company is working to grow its coverage among the top CTV platforms and is focused on building a platform that spans all aspects of CTV ad buying, from pre-bid avoidance of low-quality inventory to post-bid blocking and monitoring.

DV also wants to address marketer concerns about CTV viewability.

According to DV’s own research, a quarter of all ad impressions are served when a TV is off and half of ad impressions fail to reach the IAB’s two-second requirement for viewability. To that end, DV launched a CTV viewability measurement solution in February that applies its Authentic Ad metric to determine if an ad was viewed by a real person within the advertiser’s target geo, whether the ad was served in a brand-safe environment and whether the impression meets industry viewability standards.

DoubleVerify’s retail media revenue for 2022 grew 115% YOY. DV already works with several of the top domestic retail brands, including Amazon, Walmart and Kroger, and plans to court business from international retailers this year.

The company expects 2023 to be another year of triple-digit growth in retail media revenue.

Meanwhile, social media accounted for 37% of DV’s full-year 2022 measurement revenue, up from 31% in 2021, and only gathered steam as the year wore on. Social measurement YOY revenue growth accelerated from 24% in the first half of 2022 to 32% in the second half.

Safety on social

But brand safety remains a top concern in the social media sphere, and DV has leaned into expanding its solutions across the top social platforms.

DoubleVerify expanded its measurement platform to include brand safety and suitability measurement on TikTok late last year. And it became one of three certified measurement partners in TikTok’s Marketing Partner Program last week, earning TikTok’s seal of approval for brand safety measurement. DV’s technology classifies TikTok content as safe for advertisers according to DV’s brand safety floor and suitability categories, as well as standards set by the 4A’s Advertiser Protection Bureau and the Global Alliance for Responsible Media.

Following that integration, DV saw a 90% increase between Q3 and Q4 in the number of advertisers activating TikTok campaigns through its platform.

Despite TikTok’s relatively low penetration among DV’s user base, it grew the number of advertisers using its Authentic Ad metric on TikTok to 68 last month (up from 21 in January 2022).

DV also launched a brand safety and suitability product for Twitter in January (a timely addition considering advertiser concerns around brand safety on Twitter under CEO Elon Musk’s leadership). DoubleVerify plans to roll out a similar solution for Meta this year.

Speaking of Meta, measurement on its platforms accounted for nearly half of DV’s social media measurement revenue in 2022.

By

By