Connected TV may be online advertising’s go-to golden child – when the industry isn’t busy fawning over that other shiny object, retail media.

Insider predicts this year will mark the first time US adults spend more time watching digital video than traditional linear television.

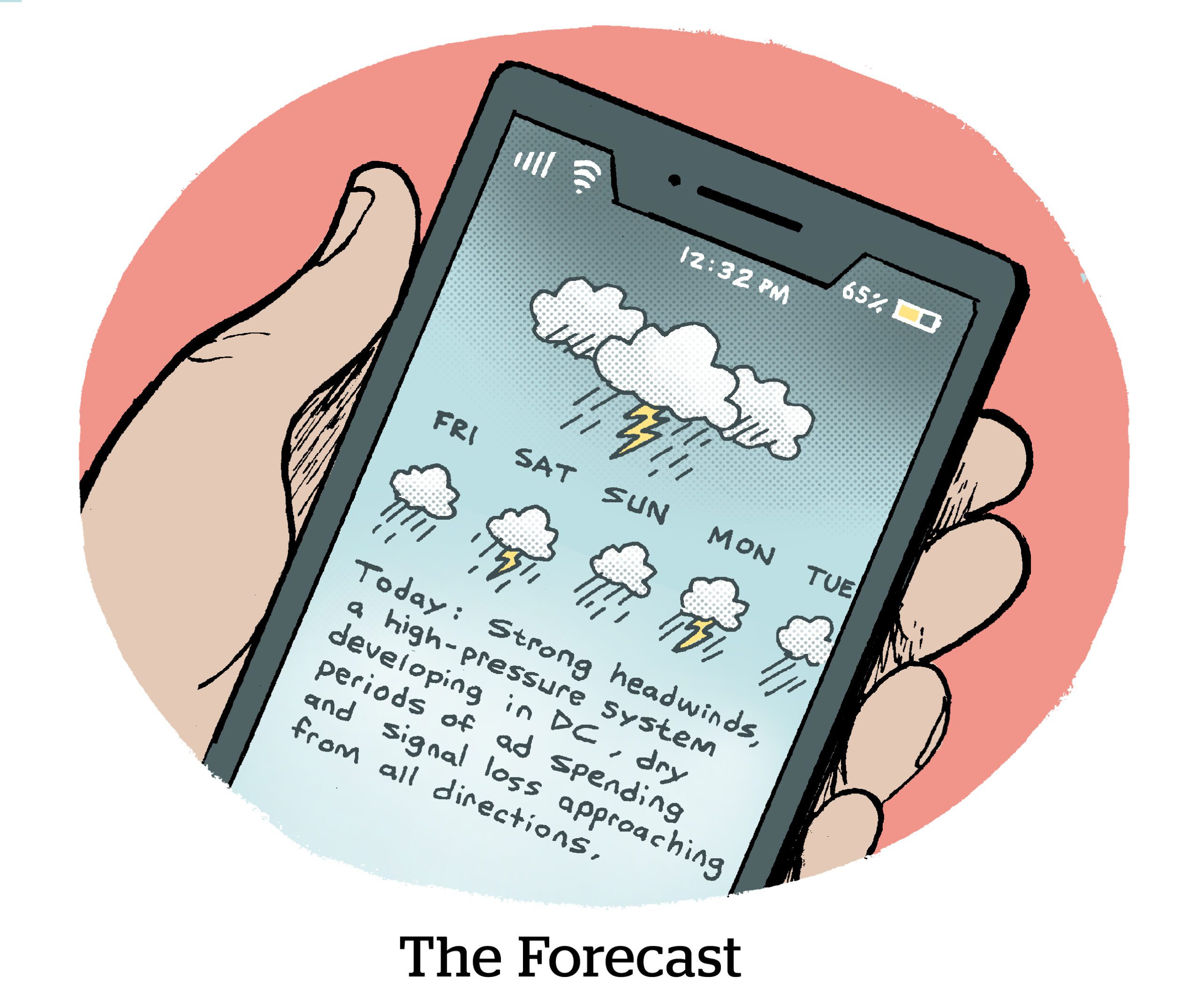

But buyers beware.

CTV buys can be risky, said Chris Kane, founder of Jounce Media, speaking at AdExchanger’s Programmatic IO event in Las Vegas last week.

And the risks are there even within private marketplace (PMP) deals, which are generally considered a safer alternative than open auctions.

Moar, please

One of the main issues is there’s only so much “premium” inventory to go around since CTV is a supply-constrained market.

When demand exceeds supply, most streaming platforms will resell ad pods from other inventory sources to fulfill an advertiser’s request. While that’s “perfectly rational behavior” on the seller’s part, Kane said, “it makes CTV a really murky pool of supply for TV buyers.”

It’s often difficult for buyers to know what they’re getting. To protect themselves, they need to do a lot of due diligence on all the CTV inventory for sale.

The good news is advertisers don’t have to audit the entire CTV universe. Only roughly 30 or so streaming companies collectively capture the vast majority – more than 90% – of CTV spend from demand-side platforms, Kane said.

The less good news is these platforms are primarily content aggregators without exclusive sales rights.

“In some cases, you know the content that you’re buying. In some cases, you don’t, because sales are so split across many different companies,” Kane said. “Each individual company doesn’t have much scaled access to exclusive supply.”

‘Sorta CTV’

Which is why advertisers that aren’t vigilant and don’t ask a lot of questions might assume they’re getting CTV inventory when, in fact, they’re buying something else – such as what Kane referred to as “sorta CTV.”

You know when you go to a diner, bar or maybe a nail salon, and there’s a screen tucked in the corner by the ceiling playing videos and ads with the sound off? That’s sorta CTV.

There’s nothing inherently wrong with that type of placement. Advertisers do willingly buy digital out-of-home in an attempt to capture attention in public places.

It’s highly unlikely, however, that advertisers looking for CTV placements specifically intend for their ads to get resold and appear within FAST content behind the lunch counter at a deli somewhere off the interstate.

And yet this category of sorta CTV inventory is “a huge part of what’s currently in the bid stream for connected TV,” Kane said.

Adjacency headaches

There can even be murkiness when buying directly from one single virtual multichannel video programming distributor (vMVPD), which could create content adjacency issues.

More than 80% of CTV spend goes to vMVPDs, according to Jounce’s estimates, such as Philo, Plex, DirecTV Stream, Roku, Hulu, Samsung TV Plus or Tubi.

Some of these streaming apps have original content, but they also aggregate from multiple other content owners, everything from Court TV, Comedy Central and Newsmax to Nick Jr., FailArmy and The Disney Channel.

Before the carriage dispute between DirecTV and Newsmax, there was a point in time when an advertiser making a buy on DirecTV Stream may have had their ads running on Newsmax because DirecTV Stream carries that channel. This could have been a brand safety issue for some advertisers.

But a different buyer might not mind advertising against Newsmax while explicitly wanting to avoid The Disney Channel – not because Disney content isn’t premium and desirable, but because maybe the advertiser is a beer brand. Running an alcohol ad against kid content is a compliance risk if you sell booze.

There’s no technical reason, though, why advertisers can’t know what content is playing on a screen.

Holding back that information is a business choice made by streaming apps, the result of incumbent media companies with streaming services trying their best to maintain control over ad budgets.

But advertisers and ad tech companies can put pressure on streaming apps to share richer signals within bid requests, including information about where ads are running.

“Some of what we’re talking about here,” Kane said, “is just basic blocking and tackling for responsibly deploying CTV investments in a way that meets a reasonable marketer’s judgment for quality.”

By

By