Microsoft’s purchase of Xandr from AT&T in late 2021 might have looked like an embrace of third-party ad tech.

But while parts of the Xandr tech are considered valuable by Microsoft, the future of Xandr as an SSP integrated with thousands of outside publishers is in doubt.

Since completing the acquisition in June of last year, Microsoft Advertising has shifted its focus to first-party products and integrations to win and secure key accounts, such as Netflix, according to multiple sources with direct knowledge of recent changes within the group.

Xandr’s third-party ad tech isn’t under a strategic review to find a buyer. Rather, Microsoft Advertising is evaluating how Xandr fits into the overall Microsoft business and has enlisted outside consultants to advise.

AdExchanger has learned that one of these consultants is FreeWheel’s former product chief, Jon Whitticom, who is also an advisor to Netflix on the streamer’s nascent advertising platform. (Netflix selected Microsoft as its global ad tech and sales partner in July.)

Although Microsoft isn’t looking to flip Xandr, the team has gone through a major reorg as part of the plan to use Xandr as a support system for Microsoft’s first-party services.

The shift toward first party will involve merging Xandr with PromoteIQ, the retail ad tech business Microsoft acquired in 2019, according to two current Microsoft employees and two who were recently let go. They say Microsoft will also integrate Xandr with Microsoft Teams, Outlook, Bing and Xbox, in addition to using it to support the Netflix CTV sales account.

Does Microsoft even want third-party tech?

A Microsoft spokesperson told AdExchanger that the company remains “committed to our end-to-end platforms that help our clients reach the audiences they need wherever they are across the open web. Nothing has changed here.”

Yet actions speak louder than words.

Current and former Microsoft employees told AdExchanger that Microsoft Advertising treats the Netflix CTV sales account as if it’s a first-party product – similar to its exclusive commercial partnership with LinkedIn. (Although Microsoft acquired LinkedIn in 2016, it operates as its own fiefdom within the larger Microsoft org.)

Microsoft’s moves aren’t unique.

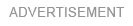

The whole market has been shifting away from third-party tech. Google’s Performance Max, Meta Advantage Shopping Campaigns and Walmart Connect are clear examples of how the biggest companies are betting on first-party data and owned media.

On the other end of the spectrum, independent third-party SSPs have struggled. Magnite recently ditched its pure-play SSP status, Yahoo abandoned its SSP business, and Big Village, which operated an SSP called EMX, simply went bankrupt.

It’s no wonder Microsoft is reconsidering Xandr’s third-party SSP business, what one might think of as legacy AppNexus.

Xandr reimagined

Xandr reimagined

But Microsoft isn’t completely abandoning Xandr’s third-party ad tech roots.

“It isn’t like they’re giving up on the SSP and DSP,” one current Xandr exec said.

Yet because layoffs have affected every part of Microsoft, there are fewer people to handle support tickets.

Due to the layoffs and restructuring, there are also “more demands” on the Xandr group now, said one Microsoft Advertising employee who’s been with AppNexus since 2015. Those demands come from internal stakeholders such as Microsoft Azure, Bing and other high-priority units in the company.

Playing a supporting role is a tough reckoning for the technology formerly known as AppNexus, said another longtime AppNexus/Xandr vet who was laid off earlier this year.

Before being acquired by Microsoft, PromoteIQ was inconsequential as a standalone retail SSP vendor compared to AppNexus. PromoteIQ brought a mere 30 or so employees to Microsoft, while Xandr came with more than 1,000 people.

But fitting into Microsoft Advertising is different than winning on the LUMAscape.

Inside Microsoft, PromoteIQ’s standing is as great if not greater than Xandr, according to the recently laid off AppNexus employee, because retail media is a high priority and third-party ad tech is not.

Memory lane

To understand Microsoft Advertising’s relationship with Xandr, one must wind back the clock to 2010 when AppNexus declined an acquisition offer by AOL in favor of a commercial partnership with and investment from Microsoft.

In 2015, AOL seemingly had its revenge after Microsoft awarded AOL a huge display advertising deal, ripped from the jaws of AppNexus. In exchange for Verizon-owned AOL switching from Google to Bing as its default search engine, Microsoft gave AOL the majority of the MSN display ad business.

Microsoft informed AppNexus that AOL would be taking over the entire business. But in a practically unheard-of account-management play, AppNexus CEO Brian O’Kelley and President Michael Rubenstein flew to Seattle to petition for the account, sources told AdExchanger.

Microsoft informed AppNexus that AOL would be taking over the entire business. But in a practically unheard-of account-management play, AppNexus CEO Brian O’Kelley and President Michael Rubenstein flew to Seattle to petition for the account, sources told AdExchanger.

The Microsoft advertising group, then led by Rik van der Kooi, put AOL and AppNexus in a one-sided bake off, with AOL selling the best parts of MSN and Bing while AppNexus retained pockets of MSN and other miscellaneous parts of Microsoft’s businesses.

AppNexus didn’t come to play, though. It created a Microsoft-specific solutions team to develop products for Microsoft, according to three sources who were on AppNexus’s Microsoft team. This team developed what today would be called programmatic guaranteed and private marketplace deals.

The depth of product work that AppNexus put in as a vendor to retain Microsoft – which at the time was a desperate concession to preserve a toehold on the account – set the stage for how sales and engineering are now used within the Microsoft fortress.

No third party, no problem

Zipping back to the current day, one might wonder why Microsoft acquired third-party ad tech if it didn’t intend to use it to its full potential across the open internet.

But for Microsoft, the Xandr deal can pay off in a big way if it’s able to help the advertising unit wring more media revenue from owned-and-operated surfaces, including Xbox, Microsoft Outlook and Microsoft’s app store, said Ana Milicevic, a principal at media and marketing consultancy Sparrow Advisers.

And to fulfill that ambition, Microsoft still needs programmatic pros.

Since the latest reorg in March, the ads group has prioritized programmatic expertise – particularly AppNexus vets who are familiar with Microsoft’s internal solutions.

One developer who was part of the solutions team that AppNexus created for Microsoft during the AOL drama told AdExchanger that because of this deep knowledge “we always assumed Microsoft would acquire us, even [during] the AT&T stint.”

“We’re the old-school IT people for them,” the developer said, “the only ones who know how all this weird Microsoft stuff works.”

By

By