Disney’s Lisa Valentino is speaking at AdExchanger’s Industry Preview in New York City on February 7. Click here to register.

In the years before streaming consumption overtook cable, planning for the TV upfronts in January would be like holiday shopping in July.

But not so in the era of AVOD.

This year, Disney bumped up its annual tech and data showcase from March to January so as to have an opportunity to show off its ad targeting and measurement chops in time for the upfronts. (NBCUniversal also moved up its developer conference, which is taking place in February this year as opposed to March.)

“This showcase was very intentionally timed – we really are in the upfront preplanning period now,” Lisa Valentino, Disney’s EVP of client solutions and addressable enablement, told AdExchanger.

Disney executives took more than 100 meetings at CES in Las Vegas earlier this month to gauge what marketers are looking for at this year’s upfronts and structured its showcase accordingly, Valentino said.

So, what’s on their wish list? Marketers want targeting, programmatic scale and measurement.

More specifically, they want multiple measurement options, she said.

As Nielsen fights to keep its throne with the release of Nielsen ONE, some advertisers have committed to transacting using alternative currencies.

Valentino spoke with AdExchanger.

AdExchanger: How will Disney+ stay ahead of all the AVOD competition?

LISA VALENTINO: By making it easier for advertisers to buy Disney inventory with deduped impressions.

Bringing Hulu’s ad targeting capabilities to Disney+ means Disney+ data will now filter into our audience graph, which is what fuels all of our ad targeting across Disney’s supply. Buying a Disney audience segment that delivers across all our addressable endpoints creates the targeting parity that ties into more consistent measurement.

Connected TV measurement is still a mess. What are buyers asking for from publishers?

At a very basic level, buyers want to understand incremental reach and frequency across their linear and streaming buys. That’s what we’re working on doing with Samba TV and VideoAmp – and Nielsen ONE is debuting this year, too.

Marketers also want to connect ad exposures to outcomes, so we’ve expanded our relationship with EDO into streaming. Disney was already working with EDO to tie search activity and web conversions to impressions on live sports.

Will Disney transact against alternate currencies during this year’s upfront?

We’ll continue to use measurement partners like VideoAmp, Samba TV and EDO as additional layers of measurement.

But it’s still premature for alternate measurement to be the standard currency in this upfront.

The biggest challenge for alt currency vendors is scalability. They don’t have enough scale across linear and streaming households to take over the current currency yet. Also, not all alt currency solutions can solve for deduped reach and frequency across other channels, like out-of-home and mobile.

Still, alt currencies are making a lot of progress on what we’re looking for as a network, and Disney plans to be flexible.

Speaking of scale, how can publishers get more out of their impressions?

Programmatic really helps scale first-party data by commingling it.

Matching Disney IDs to The Trade Desk’s UID2 boosts match rates and performance, and we hope to see that level of scale by partnering with other DSPs, too. There’s definitely demand – we got 10 calls from other UID2 advertisers the day after we announced Unilever as the first buy-side partner to test our UID2 activation.

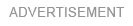

Programmatic activation for CTV really comes down to interoperability, and clean rooms make that possible. If we wanted to do this deal three years ago, we wouldn’t have been able to from a privacy standpoint.

But clean rooms alone can’t give advertisers deduped reach and frequency across different publishers. Does Disney plan on making its clean room interoperable with other networks?

More to come on that. There’s a lot of exploration happening with cloud-based solutions and multi-party clean rooms. For now, though, Nielsen ONE is the only scalable product on the market for cross-platform reach and frequency at the campaign level.

This interview has been edited and condensed.

By

By