Never a dull day in retail media.

Criteo, which is all-in on its retail media business, is reportedly for sale, and rumors were flying between sessions at AdExchanger’s Industry Preview event in New York City on Tuesday about who could plausibly buy it. (The Trade Desk? Shopify? Yahoo? Private equity? Booo.)

Retail media as a category is set for explosive growth. GroupM forecasts the total global retail media market to increase 60% over the next five years, hitting $160 billion by 2027.

But retail media network (RMN) offerings overall still have a ways to go before they’re able to satisfy several basic buy-side demands, including better measurement, more transparency and some form of standardization.

“There’s a lack of standardization on the retail side,” said Vinny Rinaldi, head of media analytics, data and technology at Hershey’s, speaking at Industry Preview.

For example, even some of the largest retailers have sub-30% viewability for the media on their sites, which is well below even the bare MRC minimum of 50%.

“That’s a problem if you want to be looked at the same as other media networks,” Rinaldi said. “If you want to be on the same playing field, then you should be adopting and actually using the same standards.”

Rinaldi’s observations speak to a broader dynamic.

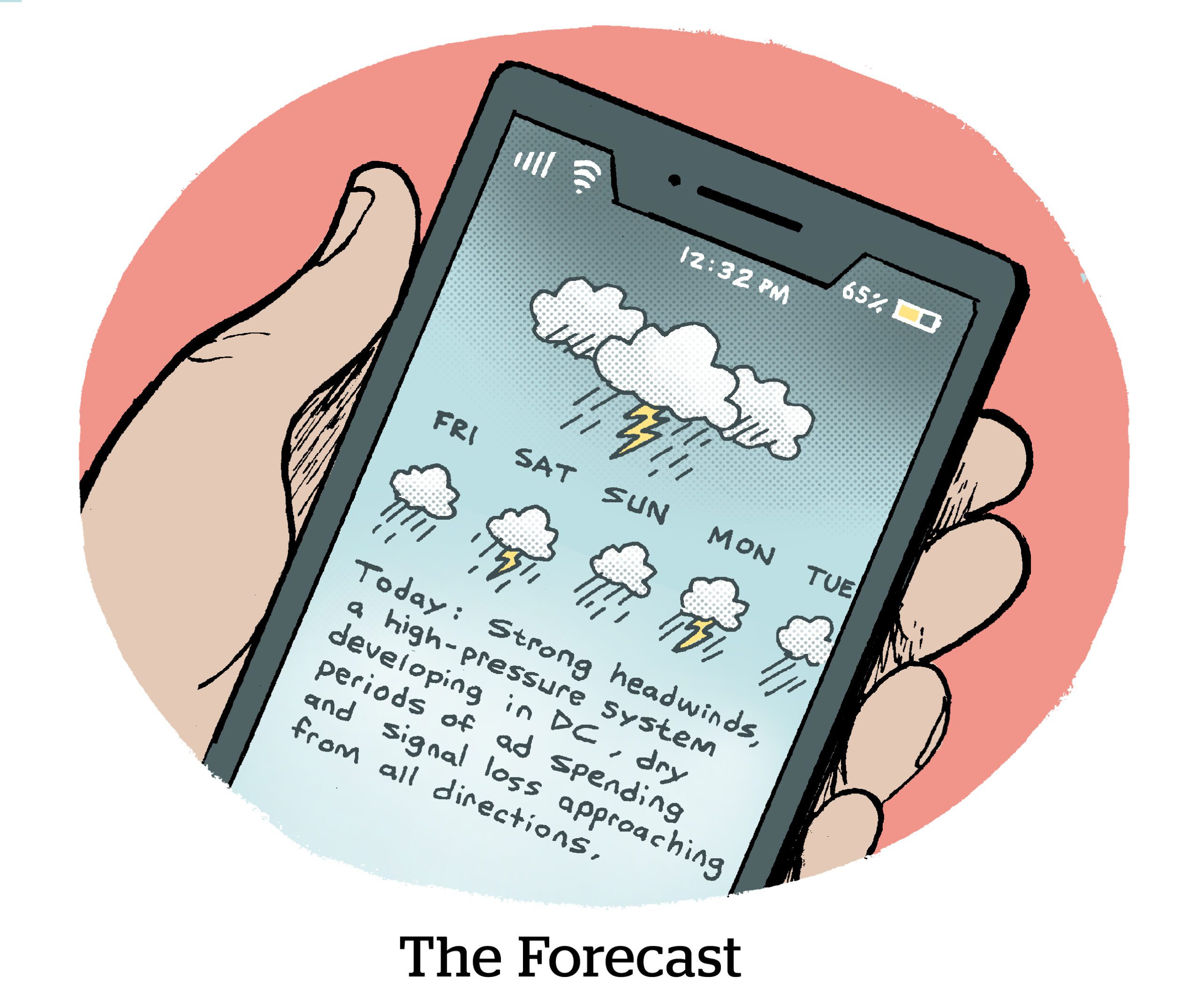

Although 56% of advertisers work with five or more retail media networks, according to research released last week by the Association for National Advertisers (ANA), the vast majority of brands (85%) say they feel pressured by retailers to support RMNs. Meanwhile, 42% of those advertisers are what the ANA referred to as “reluctant buyers,” who view RMNs as a “have to buy” rather than a “want to buy.”

Some of that reluctance is really just buyer frustration over the quality, cost and consistency of data across their various retail media partners. Since each RMN is its own little walled garden fiefdom, cross-platform measurement is pretty much a nonstarter, at least for now.

Yet RMNs charge top dollar for their data. The “markups on their own audiences are astronomical in comparison to what we’re used to buying,” Rinaldi said.

“If you’re going to be three times the cost of other data, you better perform three times better, whether it’s measurement or advanced analytics,” he said.

Which is why there’s an opportunity for retailers to offer more transparency and flexibility as differentiators – not just from other RMNs but from the gorilla (that ate the elephant) in the room: Amazon.

If retailers make it easier to buy and apply their purchase data to advertising, marketers will be less on the fence about their retail media investments. And the data really is worth it, said Jed Dederick, chief client officer and EVP of The Trade Desk, which claims to work with 80% of the top retailers in the US.

“I will sit here and defend retailers on the value of their data, which is unbelievable, especially for CPG, where first-party data can be harder to come by,” Dederick said. “We’re seeing representative, verified buyer audiences from most of the US retailers … outperform first-party data and retargeting strategies by multiple times.”

Be that as it may, reporting remains siloed, because most retail media networks operate as mini walled gardens – and the fragmentation is real.

“Three years ago, there were probably four logos in the space, and now we’re talking about hundreds,” said Chelsea Monaco, Merkle’s VP of eRetail and commerce media, also speaking at Industry Preview.

But advertisers do expect the space to mature quickly, and they’re optimistic about RMNs. The ANA found that 52% of brands believe RMNs will be perceived as a “valuable marketing tool” within the next two years. (Just 31% of brands consider retail media networks a valuable tool today.)

The fact is, retailer partnerships are critical, especially for a CPG brand like Hershey’s. And those relationships will only deepen as RMNs mature.

“I can’t sell my products without [retailers] – I mean, my product melts!” Rinaldi said.

“We need them more than ever, but we also need to create a different value exchange between us,” he said. “That is what will be really important as we unlock opportunities in the space.”

By

By